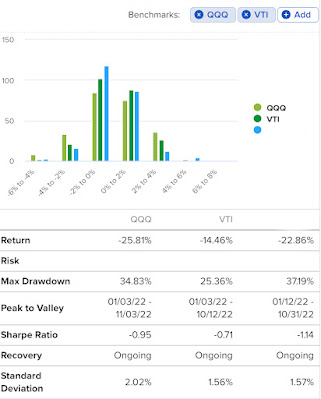

踏入十一月,奇蹟又發生,終於大市從低位反彈。YTD portfoliol由上個月跌35%升返去今個月跌23%,唉😮💨,只係跌少左少少 。自己手上太多科技股,所以表現和QQQ差不多,比VTI又差成10%,又係果句,買全世界ETF 係最最最簡單又穩定啲。攪今多野都係輸😭。

股票期權方面,今個月又中招,心急早早做左388和868的covered call,點知大市大升,好快已升到交貨價。388 係之前$410接貨返來,如果12月俾call走,就會蝕$100k,所以睇吓情況,一係再roll 去下個月睇下可唔可以升少少價位, 或收返錢直接買返貨再做covered call。 而868就roll 去左一月,大部分的貨是之前SP接返來, 大約24000股是$12 or $13價位,有10000股就在$18 接到,所以應該萬一又俾call走,又會蝕~$30k。所以睇下大市點走,見步行步,兩手準備。

頂住,加油💪

Stock (in HKD$)

BND $526

VGIT $241

AGNC $1,412

331 $4,820

1052 $1799

Sub-total (Stock) = $8,798

Bond (in HKD$)

NAVI 06/5/26 $196

Sub-total (Bond) = $196

Option (in HKD$)

Jan $19,250

Feb $26,735

Mar $22,135

Apr $19,200

May $24,260

Jun $17,665

Jul $33,345

Aug $9,270

Sept $5,495

Oct $3,190

Nov $27,420

Nov Total (Interest + Dividends + Options) = HKD$34,182 (已扣除利息支出)